Why Pet Insurance Matters in Uganda Today

Pet ownership in Uganda has transformed dramatically in the past decade. More households in Kampala, Entebbe, Wakiso, Mukono, and fast-growing suburbs like Kira, Makindye, Muyenga, Ntinda, Namugongo, Lubowa, Nansana, and Kololo are embracing dogs and cats as part of the family.

And with this shift comes an equally important reality:

pets need proper healthcare just like humans.

Why Pet Insurance Is Becoming Relevant in Uganda

- Veterinary care costs have risen as clinics adopt modern diagnostics such as ultrasound, digital X-ray, blood chemistry analysis, and advanced surgery.

- Common diseases in Uganda—tick fever, parvo, rabies, fungal infections, skin allergies—can be expensive to treat, especially when diagnosed late.

- Pet owners want predictable medical costs, instead of paying large emergency bills.

- Urban lifestyles mean pets are exposed to more risks—traffic, toxins, infectious diseases, dog fights.

Because of these changes, more Ugandans now search for:

- best pet insurance Uganda

- affordable pet insurance Uganda

- pet cover Kampala

- pet medical care Makindye

Before exploring insurance options, however, it’s key to understand how pet insurance works globally and what’s realistic in Uganda.

What Is Pet Insurance — And How Does It Work in Uganda?

Pet insurance is a financial plan where a pet owner pays a regular fee (premium) to an insurer in exchange for coverage of certain medical costs.

The Three Main Types of Pet Insurance in Uganda

1. Accident Cover

Covers injuries caused by sudden external events such as:

- Car accidents

- Falls

- Dog fights

- Broken bones

- Trauma-related wounds

This is the simplest type of cover—and the most common in emerging markets like Uganda.

2. Illness Cover

Covers medical conditions such as:

- Tick fever

- Parvovirus

- Distemper

- Kidney infections

- Skin infections

- Respiratory illnesses

Illness cover is more advanced and rare in Uganda, but extremely valuable in countries where pet insurance is fully established.

3. Routine Wellness Cover

Covers preventive health care such as:

- Annual vaccinations

- Regular deworming

- Flea & tick prevention

- Annual checkups

- Health evaluations

This type of cover is usually offered by veterinary clinics, not insurance companies — and is the most accessible option in Uganda today.

How Pet Insurance Claims Work

In well-established systems:

- You take your pet for treatment.

- You pay the veterinary bill.

- You submit a claim to the insurance company.

- The insurer refunds a percentage of the cost.

In Uganda, claims may only be possible if the policy explicitly allows pet coverage, which often requires negotiation and clear disclosure.

Average Pet Insurance Premiums in Uganda

Some accident-only or liability policies range between:

- UGX 15,000 – 60,000 per month, depending on the insurer and level of coverage.

These numbers vary widely because Uganda does not yet have standardized pet insurance packages.

Limitations You Should Expect For Pet Insurance in Uganda

Because pet insurance is not fully developed, pet owners must expect:

- Exclusions for pre-existing conditions

- Clauses requiring updated vaccinations

- Limited illness coverage

- Policies focusing on accidents, not diseases

- Slow or unclear claims processes

- Few veterinarians with insurance partnerships

This is why many pet owners rely more on veterinary clinics than insurance companies.

Is Pet Insurance Available in Uganda? (Current Market Reality)

Uganda does not currently have a complete pet insurance industry like the UK or USA.

Instead, there is a growing interest, and a few companies have started offering partial related covers.

Why Pet Insurance Is Still Underdeveloped in Kampala

- Low nationwide awareness of pet healthcare.

- Limited actuarial data, making it hard for insurers to calculate risk.

- Most local insurance companies focus on livestock, not pets.

- Veterinary care systems are still modernizing, though rapidly advancing in Kampala.

Current Gaps in the System

- No standard policies specifically written for dogs or cats.

- No illness-focused insurance.

- Wellness care is mostly self-funded.

- Emergency cover is limited to accident clauses.

What This Means for Ugandan Pet Owners

Pet owners often have to:

- Visit a vet directly

- Pay out of pocket

- Rely on clinic-based wellness plans

This is why wellness packages at veterinary clinics have become the best functional alternative to true insurance.

Best Alternatives & Emerging Pet Insurance Options in Uganda

Though full pet insurance does not yet exist in Uganda, you can still find three categories of cover that pet owners might use.

1. Third-Party Liability Cover for Dogs

This protects the owner if a dog:

- Injures a person

- Damages property

- Causes an accident

Pros:

- Very affordable

- Useful for guard dogs

- Provides legal protection

Cons:

- Does not cover the dog’s medical bills

- Limited availability

- Mainly applies to specific dog types (large breeds, guard dogs)

2. Accident & Emergency Cover

Some insurers may extend existing accident policies to pets if declared upfront.

Covers:

- Road accidents

- Fractures

- Severe injuries

- Trauma

Pros:

- Can be lifesaving

- Often cheaper than full medical cover

- Good for active dogs and outdoor pets

Cons:

- Covers injuries only

- Excludes illnesses (which are more common)

- Requires clear disclosure to insurer

3. Clinic-Based Wellness Plans (Most Reliable Option in Uganda)

These are preventive medical care packages offered by veterinary clinics.

They usually include:

- Full annual vaccination

- Worm treatment

- Parasite control

- Comprehensive annual physical exams

- Health monitoring

- Discounts on additional treatments

This is the closest thing to real pet insurance Uganda at the moment.

Pros:

- Predictable annual costs

- Immediate treatment without claims

- Covers diseases common in Uganda

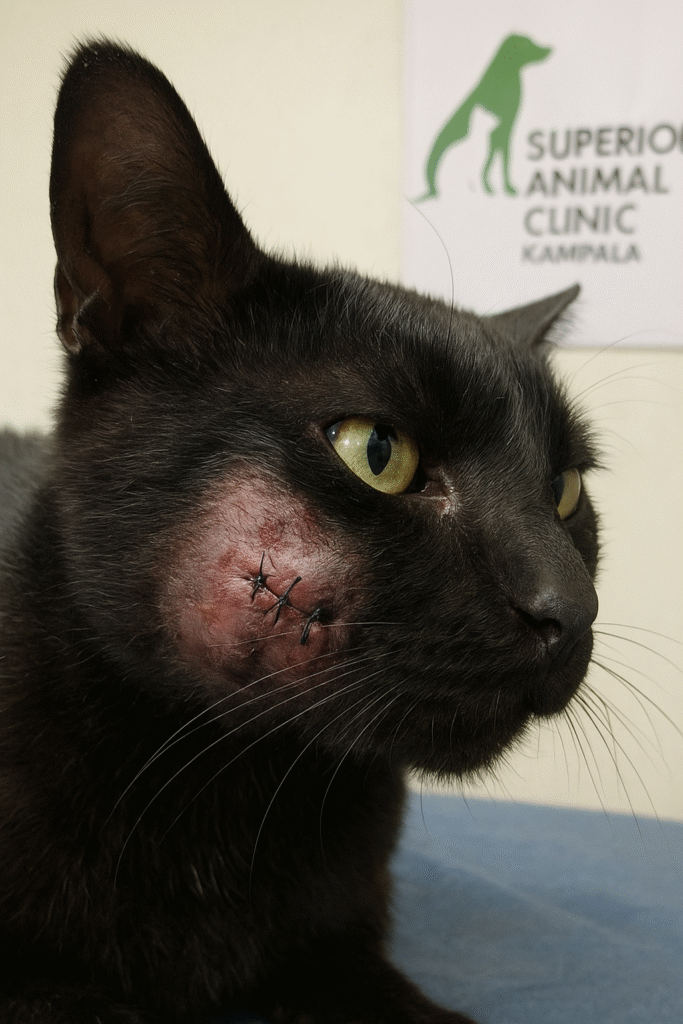

- Offered by reputable clinics like Superior Animal Clinic in Makindye

Cons:

- Does not cover unexpected surgeries

- Not offered at all clinics

- Protection is mostly preventive, not emergency-based

Price Range Overview For Pet Insurance in Uganda

| Coverage Type | Approx. Cost (UGX) |

| Liability cover | 100,000–300,000 per year |

| Accident cover | 150,000–400,000 per year |

| Wellness packages | 120,000–450,000 per year |

Vet Wellness Packages: The Closest and Most Reliable Form of “Pet Insurance” in Uganda

Because traditional insurance does not fully cover pets, wellness plans have become the smartest and most dependable option for Ugandan pet owners.

What Are Wellness Packages?

They are pre-paid healthcare bundles designed to cover essential preventive services throughout the year.

What a Typical Wellness Pet Insurance Plan In Uganda Includes

- Annual Vaccinations

Protects pets from parvo, distemper, rabies, and other deadly diseases common in Uganda. - Regular Deworming

Prevents worms that cause diarrhea, weight loss, and anemia. - Flea & Tick Prevention

Critical in Uganda to prevent tick fever (babesiosis), which is extremely common. - Annual Check-Ups

Helps detect early warning signs of disease before they become emergencies. - Health Monitoring

Vets track growth, dental health, nutrition, organs, and lifestyle factors. - Discounts on Treatments

Helps pet owners save money on procedures outside the plan.

Why Pet Wellness Plans Are Better Than Insurance in Uganda

- Designed specifically for Ugandan disease conditions

- No waiting period or rejected claims

- Affordable and predictable yearly cost

- Focus on prevention, which reduces emergencies by 80%

- Offered by reputable clinics (like Superior Animal Clinic) who understand local risks

Insurance vs Wellness Packages vs Pay-As-You-Go Vet Care

| Feature | Insurance | Wellness Package | Pay-As-You-Go |

| Accident cover | ✓ | Limited | ✓ |

| Illness cover | Partial | ✗ | ✓ |

| Vaccinations | Sometimes | ✓ | ✓ |

| Deworming | Rare | ✓ | ✓ |

| Emergency surgery | ✓ (limited) | ✗ | ✓ |

| Predictable annual cost | ✓ | ✓ | ✗ |

| Covers Uganda-specific diseases | ✗ | ✓ | ✓ |

| Immediate care | ✗ | ✓ | ✓ |

| Best for | High-risk pets | All pets | Experienced owners |

Why Vet Care Is Still Essential — Even If You Have Pet Insurance

Even if full pet insurance existed in Uganda, it could never replace a reliable veterinary clinic.

Limitations of Pet Insurance in Uganda

- May not cover chronic illnesses

- Often excludes hereditary conditions

- Claims can be rejected

- Cannot provide early diagnosis

- May require proof of vaccination and check-ups

Why You Still Need a Vet

1. Early Detection of Disease

Tick fever, kidney problems, heart disease, and parvo are common in Kampala — early detection saves lives.

2. Vaccination Requirements

To qualify for any insurance or reimbursement, vaccines must be updated annually.

3. Chronic Disease Management

Conditions like allergies, recurrent infections, and arthritis require long-term vet involvement.

4. Local Health Expertise

Vets in Makindye, Muyenga, Kansanga, Lubaga, Mengo, and Nakawa understand local diseases and outbreak patterns.

Pet insurance cannot diagnose, treat, or monitor your pet — only a skilled veterinarian can.

Tips for Choosing the Best Pet Insurance or Pet Care Plan in Uganda

- Consider your pet’s age, breed, and common health risks

- Choose a plan covering diseases common in Uganda:

- Parvo

- Distemper

- Tick fever

- Rabies

- Worm infestations

- Parvo

- Ask insurers for clear exclusions

- Compare annual costs vs benefits

- Select a vet clinic with a strong track record in Kampala

- Remember: insurance does not replace vet care — preventive veterinary support remains essential

FAQs: Best Pet Insurance Options in Uganda

1. Which are the best pet insurance companies in Uganda?

Uganda does not yet have dedicated pet insurance companies focused purely on dogs and cats. However, several reliable insurance providers offer third-party liability cover for dog owners, which can protect you if your dog accidentally injures someone or damages property. The most commonly recommended companies for pet-related third-party liability insurance in Uganda include:

- SWICO (Statewide Insurance Company) – Offers third-party liability policies suitable for dog owners.

- Jubilee Insurance – Provides accident and liability cover that can extend to pets.

- ICEA Lion Insurance – Known for flexible liability and accident riders that can apply to pets.

- Britam Insurance – Offers third-party liability options that many pet owners in Kampala use.

Since full pet medical insurance is not yet available in Uganda, many dog and cat owners rely on:

- General insurers for third-party liability

- Accident and emergency riders that can include pets

- Veterinary clinic wellness plans, which are the most consistent and comprehensive alternative

In Kampala, Wakiso, and Entebbe, most pet owners prefer veterinary wellness packages from trusted clinics like Superior Animal Clinic, because they offer predictable year-round healthcare, vaccinations, deworming, checkups, and emergency support. For the most reliable pet health care and guidance, you can contact Superior Animal Clinic (+256771909946).

2. Is there full pet insurance in Uganda?

Not yet. Uganda currently lacks dedicated pet insurance products like those found in the UK, USA, or South Africa. Instead, owners can access partial cover such as accident cover, third-party liability, and clinic wellness plans.

3. Can dogs and cats get medical insurance in Kampala?

Not full medical insurance, but pets in Kampala can get:

- Accident-related insurance cover

- Third-party liability insurance

- Veterinary wellness plans for routine health care

These options are the closest alternatives to full insurance available in Uganda.

4. What type of pet insurance is available in Uganda?

Uganda currently offers:

- Third-party liability insurance for dogs

- Accident and emergency cover (through general insurers)

- Vet-clinic wellness plans that include vaccinations, deworming, tick control, and annual checkups

These plans protect pets in Kampala areas like Makindye, Muyenga, Kansanga, Ntinda, Kololo, Naalya, and Entebbe Road.

5. Which pet insurance option is most reliable in Uganda?

The most reliable option today is a veterinary wellness package, such as the ones offered at Superior Animal Clinic in Makindye. These plans cover essential year-round services that traditional insurers do not include, such as:

- Vaccinations

- Deworming

- Tick and flea control

- Annual exams

- Health monitoring

6. How much does pet insurance cost in Uganda?

Partial pet-related cover (such as accident or liability cover) ranges from:

- UGX 100,000 – 300,000 per year for liability

- UGX 150,000 – 400,000 per year for accident cover

Vet wellness packages can range between - UGX 120,000 – 450,000 per year, depending on the clinic and services included.

7. Does pet insurance in Uganda cover illnesses like parvo, tick fever, or distemper?

Most insurance companies in Uganda do not cover illnesses. That is why vet-clinic wellness programs are preferred — they focus on preventing these diseases through vaccinations, tick control, and early detection.

8. Do pet insurance companies in Uganda cover vaccinations and routine care?

No. Traditional insurers rarely cover routine veterinary services. However, wellness plans offered by clinics do cover these essentials.

9. Are wellness plans better than insurance plans in Uganda?

Yes, for the current Ugandan context. Wellness packages offer more practical and comprehensive coverage for pets in areas like Kampala, Makindye, Wakiso, and Entebbe, including:

- Vaccinations

- Deworming

- Parasite control

- Regular checkups

These services directly address the most common health problems affecting pets in Uganda.

10. Can vet clinics in Kampala provide insurance-like services?

Yes. Veterinary clinics such as Superior Animal Clinic Makindye provide insurance-like wellness packages that offer routine preventive care at affordable fixed costs.

11. What is the best pet insurance option for dogs in Uganda?

For dogs in Kampala and surrounding areas, the best options are:

- Third-party liability insurance (for protection against property damage or injury caused by the dog)

- Accident cover (for trauma-related incidents)

- Wellness plans (for routine medical care)

A combination of accident cover + wellness packages provides the most complete protection in Uganda.

12. What is the best insurance solution for cats in Uganda?

Because cats rarely require liability coverage, the best option for cats is a clinic-based wellness plan that covers vaccinations, deworming, tick/flea control, and routine checkups.

13. Is it cheaper to insure my pet or pay for vet care out of pocket in Kampala?

For most pet owners, wellness plans are more cost-effective than insurance or emergency-only care. Preventive treatment saves money by avoiding major illnesses like tick fever, parvo, and internal parasites.

14. Do I need a vet even if my dog or cat is insured?

Yes. Insurance (where available) does not replace veterinary care.

You still need regular checkups, vaccinations, and preventive treatments from a trusted vet clinic like Superior Animal Clinic Makindye.

15. Which areas in Kampala can access reliable pet care and wellness plans?

Pet owners in Makindye, Muyenga, Kansanga, Kabalagala, Ntinda, Naguru, Kololo, Naalya, Bukoto, Bunga, Munyonyo, Entebbe, and surrounding neighborhoods have easy access to clinic-based wellness programs from reputable clinics such as Superior Animal Clinic.

Conclusion: Protect Your Pet’s Health the Smart Way

Pet insurance options in Uganda are improving slowly, but they remain limited. The best protection you can give your dog or cat today is a combination of:

- A reliable wellness plan

- Routine veterinary check-ups

- Preparedness for emergencies

For personalized advice on the most cost-effective pet care plan, consider visiting Superior Animal Clinic in Makindye, where compassionate, expert, and affordable veterinary care helps pets live healthier and longer lives.